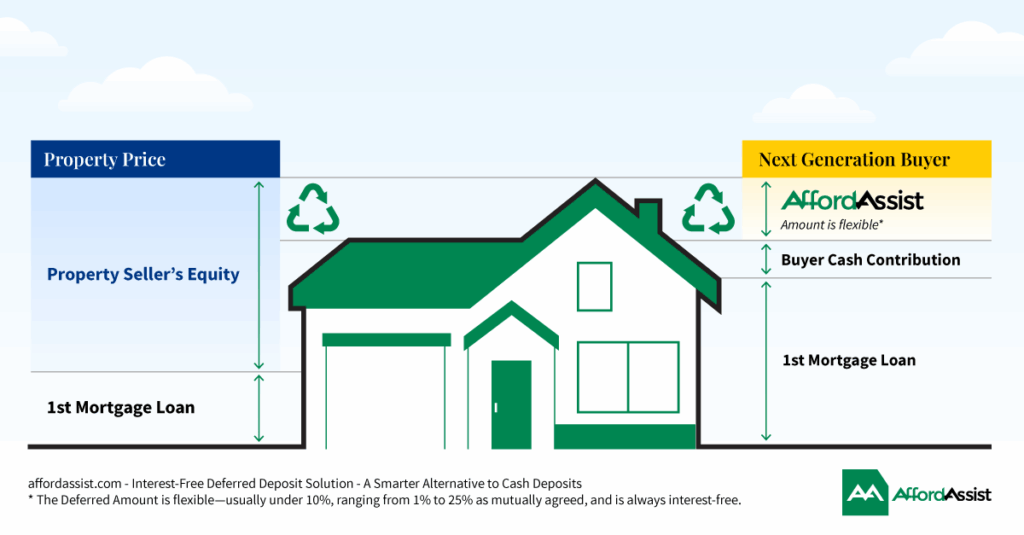

A Solution That Can Help Government Save Billions in Subsidies – AffordAssist Shifts the Affordability Dial

Dear All, Traditionally, the word deposit has meant the same thing in Australian property:A large sum of cash upfront — or cash sourced through external funding, guarantees, the Bank of Mum and Dad, SMSFs, complex and often expensive financial arrangements, unsuitable loan products, capital pools, government grants, permanent subsidies, or third-party investors. Driven by present-day […]